fulton county ga vehicle sales tax

Title Ad Valorem Tax TAVT The current TAVT rate is 66 of the fair market value of the vehicle. The City of Fulton has depended on the vehicle sales tax averaging between 40000 and 120000 each year to fund city projects.

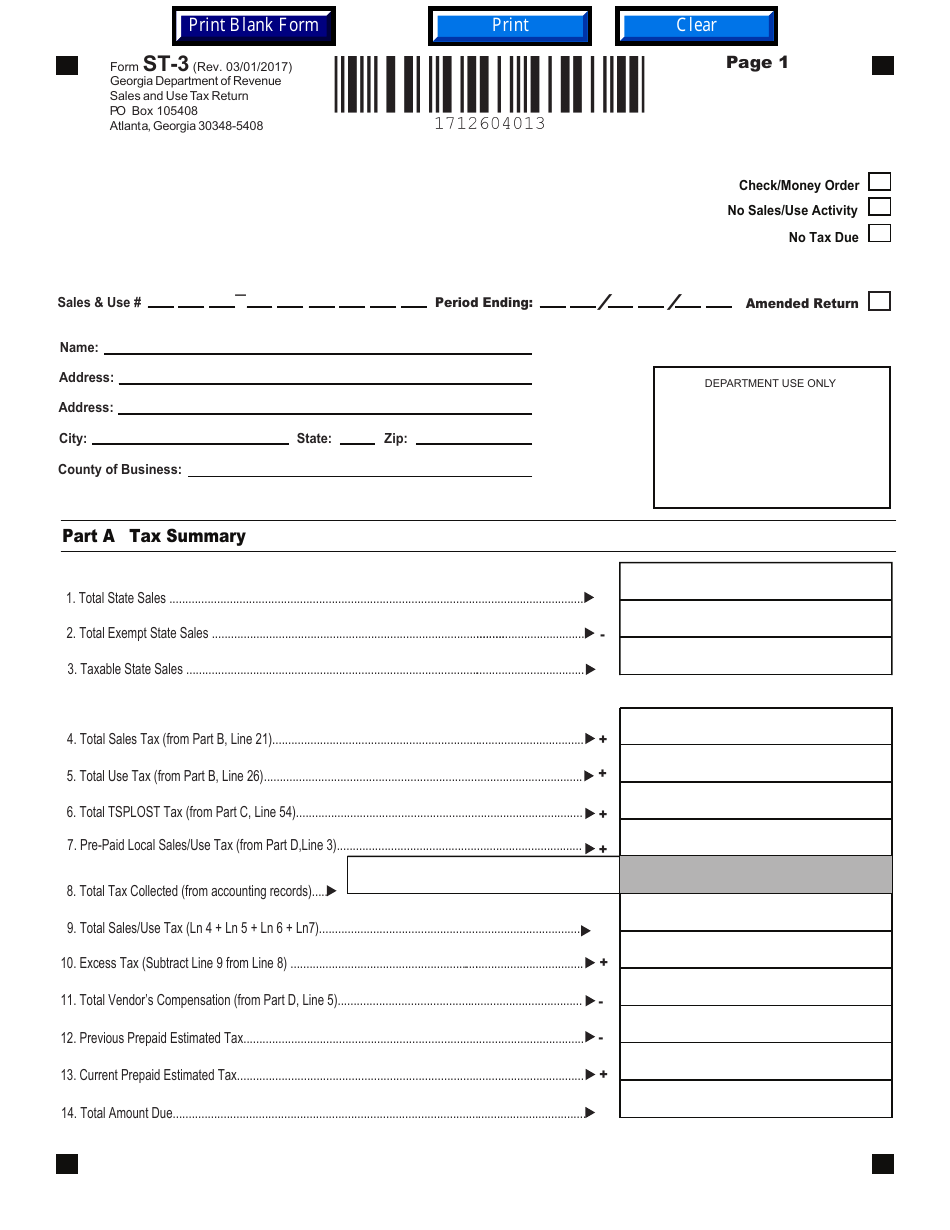

Form St 3 Download Fillable Pdf Or Fill Online Sales And Use Tax Return Georgia United States Templateroller

Please submit no faxesemails the required documentation for review to the following address below.

. Local counties cities and special taxation districts. The Georgia state sales tax rate is currently. The tax rate for the first 500000 of a motor vehicle sale is 9 because all local taxes apply.

Title Ad Valorem Tax - Motor vehicles purchased on or after March 1 2013 and titled in this State are exempt from sales and use tax and annual ad valorem tax. Refund requests must be made within one 1 year or in the case of taxes three 3 years after the date of the payment of the tax or license fee Refer to OCGA. Sales Tax Rates - General.

6 rows The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state. Back Property and Vehicles. All taxes on the parcel in question must be paid in full prior to making a refund request.

Present your photo ID when you arrive to receive your bidder ID card. The minimum combined 2022 sales tax rate for Fulton County Georgia is. Tax Sales-Excess Funds Procedure Application.

GA 30303 404-612-4000 customerservicefultoncountygagov. Motor Vehicle Recording Transfer Taxes Sales Use Taxes Fees Excise Taxes. If you need reasonable accommodations due to a disability including communications in an alternative format please contact the Disability Compliance Liaison at 404612-9166.

In addition to taxes car purchases in Georgia may be subject to other fees like registration title and plate fees. TAVT is a one-time tax that is paid at the time the vehicle is titled. GA 30303 404-612-4000 customerservicefultoncountygagov.

Documents necessary to claim excess funds in Fulton County below are the instructions on submissions. The Motor Vehicle Division of the Tax Commissioners Office assists citizens with titling and registering motor vehicle equipment as mandated by law. 185 Central Ave 9th Floor.

Georgia Tax Center Help Individual Income Taxes Register New Business. You can find these fees further down on the page. Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am.

The Fulton County Sheriffs Office month of November 2019 tax sales. Fulton County Initiatives Fulton County Initiatives. Vehicle registrations are handled through the Office of the Fulton County Tax Commissioner.

The Fulton County sales tax rate is. This is the total of state and county sales tax rates. The 2018 United States Supreme Court decision in South Dakota v.

Infrastructure For All. GA 30305 Kroger 800 Glenwood Avenue SE Atlanta GA 30316 Kroger 725 Ponce De Leon Ave NE. The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments.

Tax Sales - Bidder Registration. Title Ad Valorem Tax TAVT became effective on March 1 2013. Sales Tax Bulletin - New Atlanta and Fulton County Sales Taxes.

OFfice of the Tax Commissioner. Get a Vehicle Out of Impound. General Rate Chart - Effective April 1 2022 through June 30 2022 2219 KB.

The Fulton County Sales Tax is 3. Some cities and local governments in Fulton County collect additional local sales taxes which can be as high as 19. Please type the text you see in the image into the text box and submit.

Bidder ID cards will not be issued after the tax sale is under way The information entered in the following application will be used to. A tax sale is the sale of a Tax Lien by a governmental entity for unpaid property taxes by the propertys owner. The current TAVT rate is 66 of the fair market value of the vehicle.

Online registrations must be verified in-person between 830 AM and 945 AM on the day of the tax sale. 2685 Metropolitan Parkway SW Atlanta GA 30315. Our free online Georgia sales tax calculator calculates exact sales tax by state county city or ZIP code.

Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. The Motor Vehicle Division of the Tax Commissioners Office assists citizens with titling and registering motor vehicle equipment as mandated by law. There is also a local tax of between 2 and 3.

A county-wide sales tax rate of 26 is applicable to localities in Fulton County in addition to the 4 Georgia sales tax. Kroger 227 Sandy Springs Place Sandy Springs GA. For TDDTTY or Georgia Relay Access.

Tax Lien Sale Refunds. Fulton County Sheriffs Office. The Fulton County Sales Tax is 26.

Get a Vehicle Out of Impound. Property Taxes The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. Motor Vehicle Recording Transfer Taxes Sales Use Taxes Fees Excise Taxes SAVE - Citizenship Verification.

Georgia collects a 4 state sales tax rate on the purchase of all vehicles. This is the total of state and county sales tax rates. The Georgia state sales tax rate is currently.

What is the sales tax rate in Fulton County. Vehicle registrations are handled through the Office of the Fulton County Tax Commissioner. The sales tax also allows local dealerships to stay competitive as it removes any advantage to purchasing a vehicle outside of the state.

GA 30303 404-612-4000 customerservicefultoncountygagov. The taxes are replaced by a one-time tax that is imposed on the fair market value of the. Georgia Tax Center Help Individual Income Taxes Register New Business.

The tax rate for the portion of a motor vehicle sale that exceeds 500000 is 8 because the 1 regional TSPLOST does not apply. Due to renovations at the Fulton County Courthouse. Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day.

Form St 3 Download Fillable Pdf Or Fill Online Sales And Use Tax Return Georgia United States Templateroller

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

What Is Georgia S Sales Tax Discover The Georgia Sales Tax Rate For 159 Counties

Georgia Sales Tax Small Business Guide Truic

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

![]()

Georgia New Car Sales Tax Calculator

Georgia Sales Tax Exemptions Agile Consulting Group

Georgia Sales Tax Guide And Calculator 2022 Taxjar

Green Transporter Ev3 3 Wheel Mobility Scooter Mobility Scooter Abs Brake System Scooter

Georgia Used Car Sales Tax Fees

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

What Is The Sales Tax Rate In Richmond County Ga Cubetoronto Com

How To Redeem A Tax Deed In Georgia Gomez Golomb Law Office Gomez Golomb Llc

Georgia Sales Tax Rates And Compliance

Sales Tax On Cars And Vehicles In Georgia

How To Register For A Sales Tax Permit In Georgia Taxvalet

How To Improve Sales On Ebay By Giving Exceptional Service Customer Experience Improve Sales Network Marketing Business